25 Investments for 2025: A Follow-Up to the 2020 Series (Part 1)

(TLDR: Join my syndicate)

Back in 2020, I published a list of 20 startups I would invest in, something I have done in 2018 , 2014, and 2013. I’ve had the pleasure of watching many of them grow and evolve. In addition I did some personal investments (now pushing via my syndicate) and can now reflect on some of those investments 5 years later. Some highlights:

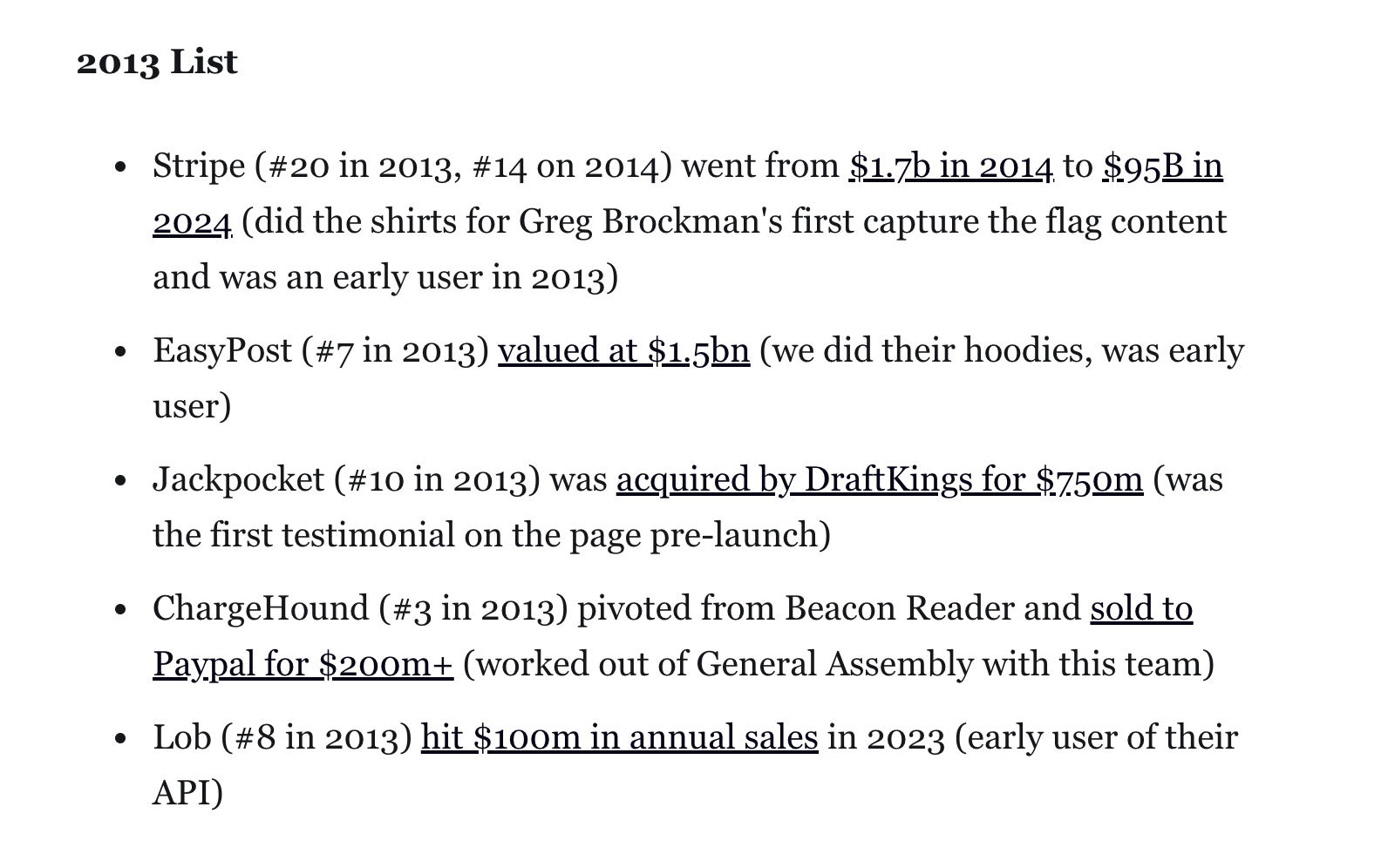

2013 List

- Stripe (#20 in 2013, #14 on 2014) went from $1.7b in 2014 to $95B in 2024 (did the shirts for Greg Brockman's first capture the flag content and was an early user in 2013)

- EasyPost (#7 in 2013) valued at $1.5bn (we did their hoodies, was early user)

- Jackpocket (#10 in 2013) was acquired by DraftKings for $750m (was the first testimonial on the page pre-launch)

- ChargeHound (#3 in 2013) pivoted from Beacon Reader and sold to Paypal for $200m+ (worked out of General Assembly with this team)

- Lob (#8 in 2013) hit $100m in annual sales in 2023 (early user of their API)

2014 List (15 companies)

- Barricade.io (#2 in 2014) acquired by Sophos

- Readme.io (#3 in 2014) profitable 3k users and 9M series A at Readme.com

- Envoy (#7 in 2014) raised $111m series C in 2022 (met as a subscriber to Startup Threads)

- Trustev (#9 in 2014) acquired for $44m by Transunion

- Hired (#10 in 2014) acquired by Vettery

- Everlane (#11 in 2014) raised $90m in 2022 (referred first employee who pivoted the business from referral to production)

2018 List (11 companies)

- Lomotif (#4 in 2018) was acquired for $125m

- Lumi (#11 in 2018) was acquired by Navar

- Artiphon (#1 in 2018) launched Orba ($1.4m kickstarter)

2020 List (20 companies total)

- Smart Sweets (#18 in 2020) was bought by TPG for $400 million 10 months later

- Clearbit (#11 in 2020) acquired for $150m cash in 2023

- MSCHF (#1 in 2020) taking over with with Big Red Boots, Global Supply Chain Telephone Bag , raising $11m. I was featured in the NY Times article on it as they have grown their overall impact on culture. Spoke at my conference in SXSW 2019.

- Pachama (#20 in 2020) landed a $64m Series B a year ago

- StrongDM (#3 in 2020) raising $34m this year (did sales consulting to help them get CTOs on board in 2018)

- Sanzo (#5 in 2020) got distribution in 3,500 retailers, raised $8m from Steve Aoiki and Simu Lui

- Omsom (#4 in 2020) did $3.7m in sales in 2023 and sold to DayDayCook in 2024 (early customer when the name was Oxtail, got my mom using their product)

- Taskade (#12 in 2020) raised $5M seed

- Trials.ai (#9 in 2020) acquired by ZS

Personal Investments (Since 2020)

- Secureframe (#goated investment) raised a $56m Series B

- RoboFlow (#goated investment) raised a $20m Series A and used by Ballers

- Upstream (#goated investment) raised a $12.5m Series A

Sadly most of these I never had an actual financial interest as I wasn't ever able to convince a venture capitalist to let me be a scout (sidenote: I would still entertain this, only if its for Brian Cohen, Alexis Ohanian (Seven Seven Six), Kirsten Green (Forerunner), Shana Fisher (Third Kind VC), Ryan Hoover (Weekend Fund), Amy Millman (Springboard http://sb.co) Jessica Livingston or Cyan Banister. It is fun, though, to see other entrepreneurs success, validating not just their innovative ideas but the resilience and ingenuity of their founders. These entrepreneurs weren't just smart; they were adaptable, relentless, and focused on the right market opportunities. And now, as we look toward 2025, it’s time to refine those criteria even further.

What I've Learned

In 2020, I focused on market potential and innovation. But as the last few years have taught us, compliance, user experience, and clever product marketing can be the difference between a startup that just makes noise and one that truly scales. More importantly, my investment philosophy has sharpened around people—though many investors say they focus on founders, I believe in going deeper. I’m investing in people who are:

- Resilient (think Jensen Huang—someone who can weather a storm and emerge stronger).

- Open-minded (constantly learning and evolving, with the humility to adapt).

- Pursuing the right market (no matter how brilliant you are, timing and market fit are essential).

Criteria for 2025

The following companies and individuals represent the kind of people and ideas I believe in for the future. They check all the boxes: compliance and regulation-savvy, focused on user experience, and powered by clever product marketing. Most importantly, they are led by founders with the drive and vision to succeed in challenging markets.

Stay tuned for Part 2